It’s commonly understood that buying a house is a good investment over the long term. However if you have spent any time browsing social media you have probably heard people say things like ” Renting is better than buying a house”, or “The Homeownership Myth”. Today I want to conduct a brief data driven study to see if these influencers have a point or if they are leading others down the wrong path.

Meet Tom, our prospective Home buyer looking to see if he should rent or buy. In order to conduct this study I had to make a few assumptions. I will touch on all these assumptions at the end of this post. The first Assumption I have to make is that Tom has a savings of 34239.47 which is the average down payment in the US( https://www.forbes.com/advisor/mortgages/average-down-payment-on-a-house/)

I found that the average cost for a one bedroom one bath apartment in the US was $1,657 a month(https://www.rentcafe.com/average-rent-market-trends/us/)

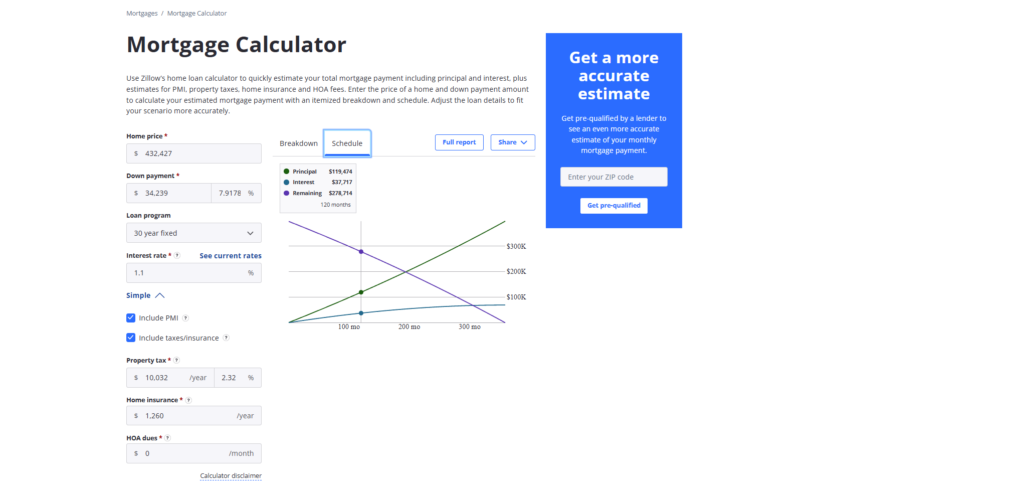

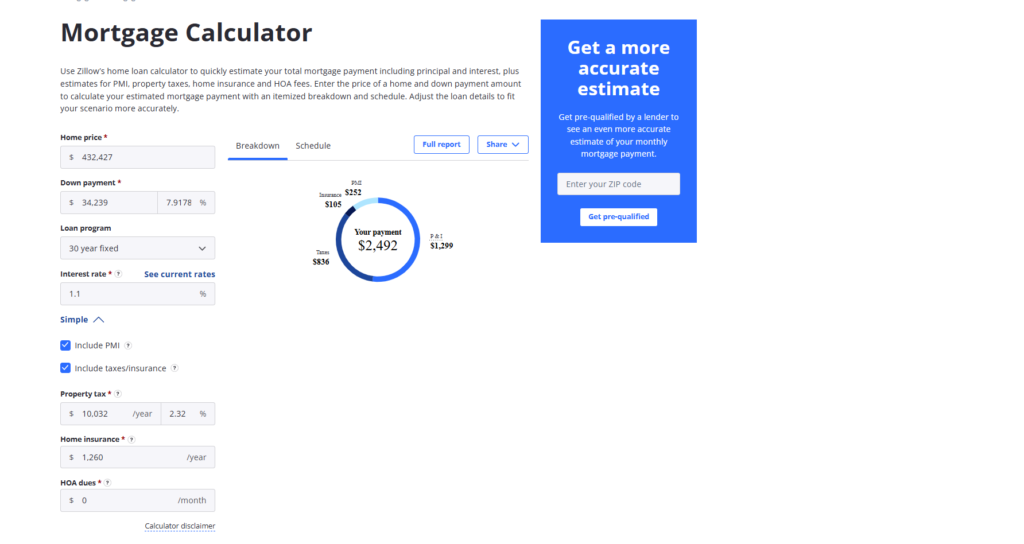

The Average Cost for a mortgage in the US was $2,493.98 (https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html)

The Renters “Trap”

Tom has come to a Pivotal decision. Does he spend this money, Invest, Or put his money in a savings account? If Tom decides to spend his money since its “extra” he has fallen into the trap many Americans slip into when they begin renting. The reason treating this money as “extra” is a mistake is because if Tom were to have bought the house at least some of that “extra” money would be going to his house equity and in turn into his own pockets. After 10 years Tom still only has his 34239.47 in his savings. This is where convention wisdom says renting is burning money because you never see it again. However Convention wisdom does not take into account that on average it is cheaper in the short term to rent than own. So the real question is what do you do with that money? Lets continue on with another scenario where Tom saves his money into a savings account.

Saving Account

For traditional savings account the average APR is often so small that it is negligible. I was liberal in this analysis because I assumed that Tom would put his money into a high yield savings account that got 4% per year of returns. If Tom put the 34239.47 down payment and 836.94 monthly contribution into this high yield saving account he would have $174,284.57 at the end of 10 years.

Here is the formula used =FV(0.04/12, 10*12, -836.94, -34239.4705882353, 0)

If Tom instead stuffed all that cash under his mattress or used a traditional savings account he would only have 100432.8 saved at the end of 10 years.

Here is the formula used =(836.94*12)*10

We can now see that tom has saved 174,284.57 in his high yield savings account! Much better than the 34239.47 in his savings when he was spending the “extra” money. Let’s analyze what would happen if Tom invested the down payment into the S&P 500?

Invested in S&P 500

The S&P 500 had an average annual return of 11.66% over the last 95 years. So let’s calculate what the return of the investment would be in 10 years if Tom invested his down payment of 34239.47 and contributed the 836.94 monthly to his investments. Tom would have an investment worth $297,993.10 at the end of 10 years.

Here is the formula used =FV(0.1166/12, 10*12, -836.94, -34239.4705882353, 0)

The interesting part of this study is clearly inventing the difference paid off the most. Let dive into what Tom might look like if he bought the house instead.

The American Dream

Tom Buys a home for the average cost of 432427.45$(https://www.bankrate.com/real-estate/median-home-price/#median-price-by-state). Tom uses the 34239.47 he had saved and gets a 30 year mortgage for 2,493.98 a month. After 10 years Tom does not have any saving’s in his account and is still paying the 2493.98 mortgage payment. However his house has appreciated in value by 4.42% which is the average appreciation in real estate in the last 95 years. His house is now valued at $672,231.34 and he has payed 119,474 towards the principal of his house. His total equity which equals his current house value – original house value + amount contributed towards principle is now $359,277.89 . With that we can conclude that buying the house yielded a higher increase in net worth over 10 years. Without getting into the flaws of my study lets look at one more factor.

Without getting into the flaws of my study lets look at one more factor with the two most successful methods of increasing net worth. Who would have a higher net worth after the full 30 year fixed mortgage? Using the same formulas mentioned above but increasing the period to 30 years gives interesting insights. The Tom that Rented and invested his money in the S&P 500 has $3,825,528.85 after 30 years while the TOM that bought a home has paid off his mortgage and has a equity value of $1,311,584.14 . This demonstrates the power of compounding interest. Because The S&P 500 has historically had higher returns than real estate appreciation over time the investment in the S&P 500 out performs the investment in the house by a wide margin.

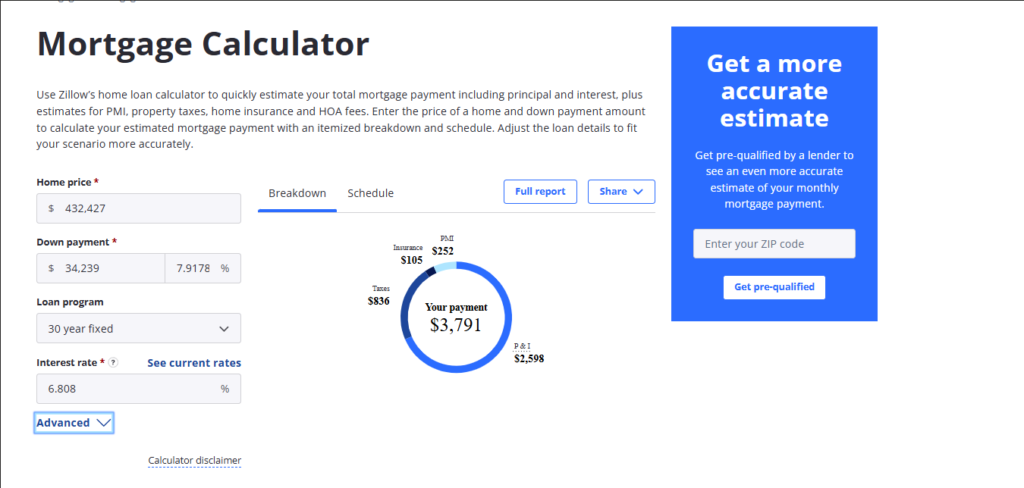

The problem with my study is that a 1.1% interest rate does not exist. Clearly the data for the average mortgage payment and average house cost are not aligning for a new perspective home buyer that only has the average down payment available to spend. Unfortunately for Tom his payment would look more like something below, making the disparity between renting and buying even larger.

Conclusion

Though renting does not build equity is less expensive in short term if you are living within your means. This allows you to take advantage of compounding interest investing in the Market. Unfortunately many young people cannot afford a home, if the option of buying a house is not on the table then objectively you will be better off financially if you invest your disposable income.

Renting when you invest your disposable income vs homeownership equal similar increases to net worth after 10 years than I think many people realize.

Below are the assumptions for factors that would make this research much more accurate and cumbersome to demonstrate.

Assumptions:

- I assumed that Tom is living within his means

- Tom Has the average down payment to place on a home.

- I Assumed Tom did not have any additional disposable income after the average cost of a mortgage amount

- rent does not increase over time

- property Taxes, interest rates, mortgage insurance do not increase over time

- Tom would pay for either the average price of a one bedroom one bath apartment or the average price of a mortgage payment

- I assumed there was no maintenance involved with the home, and no added charges to renters